Retail: Armageddon or Opportunity, Issue 11

Montreal-based shoe retailer Aldo Group Inc. announced Thursday it filed for creditor protection in Quebec, and will seek similar court orders in the US and Switzerland, as the fallout from COVID-19 continues to weigh on Canadian companies. https://www.bnnbloomberg.ca/aldo-files-for-creditor-protection-amid-too-much-pressure-from-covid-19-1.1432986

Reitmans Canada Ltd will seek bankruptcy protection in a Québec court on Tuesday, becoming the latest retailer to face the brunt of the COVID-19 pandemic, which has led to prolonged store closures. https://nationalpost.com/news/canada/canadas-reitmans-to-seek-bankruptcy-protection-as-covid-19-shuts-stores

New York — J.C. Penney Co Inc. filed for bankruptcy protection on Friday with plans to permanently close some stores and also explore a possible sale, making it the latest brick-and-mortar retailer to crumble as prolonged store closures in response to the COVID-19 pandemic drive a final stake through long-troubled businesses. https://business.financialpost.com/pmn/business-pmn/j-c-penney-files-for-bankruptcy-protection-2

On Thursday, all of that came to an abrupt halt when Neiman Marcus became the first major department store group to file for bankruptcy protection during the coronavirus pandemic. It’s a stunning fall that follows the collapse of Barneys New York late last year and comes as shadows gather over chains like Lord & Taylor and J.C. Penney. https://www.nytimes.com/2020/05/07/business/neiman-marcus-bankruptcy.html

These are just a few examples of the grim impact that the pandemic is having on retailers who were already suffering from the impact that online shopping was having on their in-store traffic and sales. In Canada, Reitman and Aldo banners were considered “A” tenants. Many landlords will suffer increased vacancies and eventual, inevitable downward pressure on rents, and a downgrade of asset quality resulting in higher CAP rates and mortgage interest rates. There will be exceptions. Strip mall operators that focus on “essential services” such as food retailers and pharmacies will have do better than enclosed malls or centres that are fashion oriented.

Many shopping mall, main street, and high street store fronts were vacant before COVID-19 and now there will be many more vacancies as the virus-related ten-plus week closures take their toll. Changes to the retail industry that were already in motion will accelerate challenging merchants, landlords, and municipalities to find new formats for bricks and mortar retail that are relevant and unique.

Emerging Trends

To imagine the future of retail, it is useful to consider emerging trends before COVID-19:

- On May 8, 2020, Nordstrom announced the permanent closure of sixteen of its department stores across the United States. This represents one in seven of its 116 full-line facilities and while stating that COVID-19 was the catalyst, the stores were underperforming and Nordstrom had already closed five full-line stores between January 2019 and the recent announcement. There were no announced closings of Nordstrom Rack stores or, perhaps more significantly, Nordstrom Local. It opened its first Local in October 2017 offering three core services: online order pick-up and return, alterations, and style advice. Other offerings include beauty services, in-store coffee bars, and stroller cleaning. Nordstrom customer tracking demonstrates that a “Local” client spend 2.5x more than its “clic” only clients. Now, there are five locations. https://www.retaildive.com/news/store-concept-nordstrom-local-dive-awards/566188/

- Groceries On-line: This was becoming a more popular option for many shoppers as grocery chains invested in the development of e-commerce platforms and delivery strategies. Amazon bought Whole Foods. Required quarantines and self-isolation strategies have driven more consumers to shop for food and grocery basics on-line. There were long wait times as the various systems that had been put in place were not built for the suddenly unexpected volumes but despite some service gaps there will be many permanent converts to online grocery shopping. There will be fewer grocery stores as we know them and more warehouse fulfilment centres? May 7, 2020: Waitrose (a high-end British grocer) has announced it will open a six-acre customer fulfilment centre in London this week in a bid to double its online grocery orders in the city by September. The centre will launch in Enfield on May 7 and will create 370 jobs which will rise to 850 when full capacity is reached.The facility will eventually add 13,000 weekly delivery slots for London customers. https://www.retailgazette.co.uk/blog/2020/05/waitrose-to-double-online-orders-with-new-fulfilment-centre/

- The Ginger Pig ( https://thegingerpig.co.uk ), Fish Works, La Fromagerie ( https://www.lafromagerie.co.uk/?gclid=Cj0KCQjwn7j2BRDrARIsAHJkxmy27xGq-NE_ZYp_yWtca4ArsD7-LDe1CBbiGOTSdz9Nl3NsojuinuwaAqAbEALw_wcB ), Fish Works, Blandford Fruit Stores, and a Farmer’s market are all within a three minute walk of the London-Marylebone Waitrose retail store. There is growing demand for a good butcher and cheese shops, fish mongers, green grocers, and bakeries.

- Clicks-to-Bricks: On-Line retailers are making the move to the high street. Frank and Oak of Montreal started as an on-line retailer and now has twenty-one stores; Everlane now has six stores; Allbirds now has 18 stores; and, Kimco’s “Clicks to Bricks Program” offers qualified online retailers one year of free rent if they open a store in one of their shopping centres in the US. It may be of interest that Frank & Oak, Everlane, and Allbirds have environmental objectives. Additionally, Everlane is committed to pricing transparency and fair labour practices.

- Part of Shopify’s success has been a focus on providing services that assist “on-street” retailers become online retailers and vice-versa.

- There are an increasing number of brands that in addition to traditional sales through arms length retailers, have built on-line sales platforms and have added on-street retail. Nike, Icebreaker, Patagonia, and Adidas are just a few examples.

On-line shopping has been stripping sales from retail malls and main streets for several years now and the current health crisis has increased the speed of evolution closer to revolution. The online experience has got to be easy and it has got to be worth it. Some retailers do it very well, typically those that have started out as on-line sellers, but others drive me crazy. Buying on-line from many of the big “bricks and mortar” retailers such as Wal-Mart, Canadian Tire, Home Depot, and many others is like going to purgatory. The Amazon web site drives me crazy so I refuse to use it.

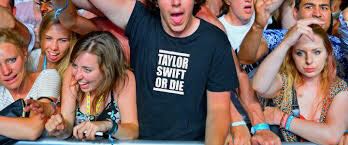

If the conditions are right, people want to be out and to go shopping but they also want an experience they can’t get by browsing on the sofa with their I-Pad. Clients are attracted to stores that offer something different and shopping areas that have a dynamic atmosphere.

- In addition to selling furniture, MUST Société puts on cooking demonstrations and has a Bête à Pain bakery in its Montréal Griffintown location.

- La Meunerie Urbaine on Montreal’s Monkland Blvd. was consistently busy pre-Coronavirus. Taste the breads, enjoy the atmosphere. This is an experience on-line shopping cannot replicate

- Unique products with excellent service — in Montreal: eyewear from Le Bar à Lunettes, menswear from Le Clusier

- I am sure that each of you will have a favourite small retailer. Use this opportunity to give them a rave review on LinkedIn.

- Support on-street shopping and help rebuild neighbourhoods. Remember your favourite small retailer as it re-opens and shop local, support local businesses, buy from local farms, and support local artisans and manufacturers.

And, as always, wash your hands, practice social distancing and wear a face mask when you can’t, hydrate, and exercise!

Updates

In Issue 6 dated April 16, ideas for the return to work included a permanent increase in the work-at-home model, staff rotations on a work-at-home / work-at-office rotation; split work weeks; reductions in workplace density; and in the longer term, a shift away from concentrating 1000 plus employees in high-density single locations to less dense configurations in smaller, more accessible buildings. As companies re-open their offices and manufacturing facilities, all of these ideas are being used by employers. Shopify expects to keep most of its employees working at home until at least January and expects many of its existing employees will work at home on a permanent basis.

In Issue 9 dated May 5, I suggested that restaurants and high street retailers needed cities to contribute to their revival by converting huge sections of the city to pedestrian malls and to allow for radical expansion of outdoor dining and retail sales. Since that time, there have been a parade of announcements by cities across North America and Europe announcing measures to close streets to cars to allow for more space to walk, cycle, scoot, shop, and dine. The City of Montreal first announced 327 kilometres of new bike and pedestrian paths and more recently announced an additional 40 kilometres of pedestrian streets. There will also be allowances for expanded terasses when restaurants re-open sometime in June.