COVID-19 and the History of Recessions, Issue 5

These words are often attributed to Winston Churchill but are from a British World War II poster. In 1939, the slogan came to represent the indomitable spirit of the British people facing impossible odds and it became reflective of Churchillian leadership throughout WW II. We are not walking the streets of London or Coventry waiting for the next air raid siren but our worlds have been turned upside down by COVID-19.

I started work at CIBC in 1968 and so I wanted to look at recorded economic recessions in Canada since that date and these are summarized in the table below. The Seventies and Eighties were marked by exceptionally high inflation and the Federal Government introduced Price and Wage controls. In the late Seventies, we were still required to send notices to borrowers when Prime rate was increased and sometimes I was signing notices twice a week. In September 1981 prime hit 21.25% as interest rate policy was used as a sledge hammer to drive down inflation.

The late Eighties and early Nineties brought the great real estate melt down. There was a “build it and they will come” attitude and Lenders were feeding the frenzy with loans against unencumbered pools and non- recourse development loans. Does this sound eerily familiar? The October 2001 Enron debacle and the collapse of the tech sector at about the same time should have been the “canaries in the coal mine” for the perils of unregulated financial engineering and greed that led to the residential mortgage meltdown in 2008. All recessions are uncomfortable and stressful. They are marked by business and personal bankruptcies, industry closures, and workforce reductions; but, they are an expected part of the business cycle. In my experience, there is always a period of irrational exuberance prior to a recession and I have been expecting a recession for some time now as:

- Stock markets have been booming, making every investor a genius;

- Levels of employment have been running at or close to all time highs

- Real estate cap rates have dropped from 9% in 2002 to below 5% in 2020

- In 2002 the Canada ten-year bond was 5.66% (already low compared to 10.85% in 1990) but 4.8x the pre-pandemic 1.16% benchmark bond rate of February 26, 2020.

- Consumer debt levels have been creeping up and while economists have addressed this issue with varying degrees of alarm, there is a point where people stop spending.

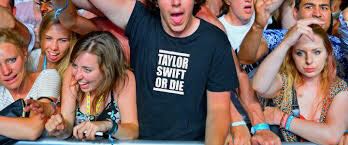

And then, along comes the Coronavirus. Nobody needs Stats Can reporting to know that the economy is now in deep recession. All non-essential industries and retailers are closed except where employees can work from home. Shopping centres are closed, high streets are empty, construction sites have been shut down, festivals are being cancelled, the hospitality and travel industry is in a holding pattern, and employment insurance

“Nobody needs Stats Can reporting to know that the economy is in deep recession”

claims are soaring.

Does anyone really think that the NHL or the NBA will finish the 2019-20 season or that baseball will have a 2020 season? Who will want to go to an NFL tailgate party or sit in a crowded stadium this year? I think the irrational exuberance that I have always seen prior to other recessions was there and that a recession was coming but this time its length and depth will notbe cured by economic levers alone. Progress in Covid-19 medical science will be needed to create the right conditions for people to go back to work.

I have spent almost 52 years in finance and worked through the five previous recessions. Most of my career has been in real estate and I have a few suggestions that apply in any economic downturn. Some simple lessons that most readers will know:

- Consolidate and conserve liquidity: close available financings, slow investment in new projects,

- Understand each property’s cash flow. This will be more difficult in this recession as many tenants abilityto pay rent will be compromised by issues beyond their control1 With Negative Bond Yields, What About Cap Rates and Canadian Real Estate, Colliers International Canada, 2019

- Focus on tenant relationships i.e.

- Some office users may want to downsize because their businesses will be smaller or because there has been large-scale adoption of “work at home” protocols. Some may need more space because of the introduction of spacing protocols. Will that high-tech company still want all that communal space?

- Retail tenants were already suffering, this recession will push many merchants and restaurants over the edge. Fashion retailers have lost the spring / summer season. Understand the survivors and focus on alternate users.

- Logistics companies were looking for more space before the pandemic and that demand has likely increased with the new focus on domestic control of critical supply chain management.

- Residential tenants will require varying amounts of care and management. Beware of reputational risk and don’t get caught being in public disputes with the vulnerable.

- Invest in relationships with capital providers. Get in front of them to tell them what is being done to mitigate the impact of this sudden, severe downturn. Everyone is about to find out how good their lender relationships are. Capital providers survive on information.

- Get ahead of the curve negotiating forbearance agreements where possible. Lenders do not like loans that go into default and will generally be willing to enter into negotiations to provide relief on a well structured and rational basis. There will be limits. There won’t be a lot of sympathy for payment deferral on an “essential services” retail plaza (pharmacy and food store) or AAA-tenanted office buildings where tenants are paying rent, especially where there is little or no relationship.

- Focus on debt service coverage, not loan to value. In recessions, the differential between the risk free rate and Cap rates always goes up so most property values will already have fallen.

- The tide has been rising for a long time lifting even leaky ships, compensating for mistakes. As waters ebb, there will be little room for error.

- Control exposure to new development.

- Review purchaser and prospective tenant lists. Are some buyers at risk? Is the target market still there?

- Does required demand and design reflect the new reality?

Now back to Churchill.for appropriate inspiration for the times:

- “I am sure that the mistakes of that time will not be repeated; we should probably make another set of mistakes.” June 1944: Churchill was responding in the house to a call not to repeat the mistakes made after the First World War.

- It is always wise to look ahead, but too difficult to look farther than you can see

- Difficulties mastered are opportunities won

KEEP CALM AND CARRY ON!! And, as always, wash your hands, practice social distancing, hydrate, and exercise! Keep well!

References:

- The Wicked Wit of Winston Churchill as compile by Dominique Enright, Michael O’Mara Books Limited, 2001

- With Negative Bond Yields, What About Cap Rates and Canadian Real Estate, Colliers International Canada, 2019